Authors: Tain-Tsair Hsu(許添財), Shin-Hsien Chen(陳世憲)

【Abstract】

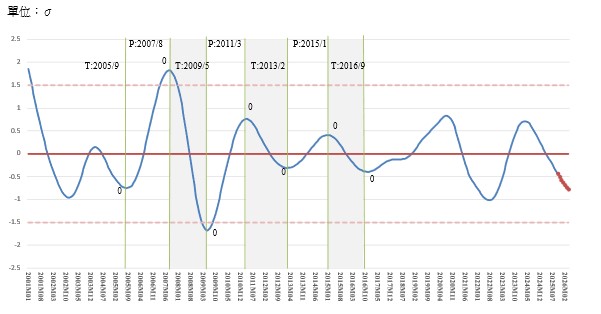

The Commerce Development Research Institute (CDRI) Commercial Service Industry Business Cycle Indicator System analysis for October 2025 shows that the Coincidental Cyclical Composite Index for Service Industry (CCCIS) peaked in April last year (2024). By October this year (2025), the standardized Cyclical Composite Index had fallen to -0.4379 Standard Deviations and is predicted to continue falling to -0.7782 Standard Deviations by April next year (2026). A closer look at the trends of the sub-indicators reveals that the uneven recovery is becoming more divergent. The increasing number of declining sub-indicators is also causing the recessionary Diffusion Index to expand continuously. Among the five sub-indicators, only “Wholesale and Retail” remains on an upward trend.

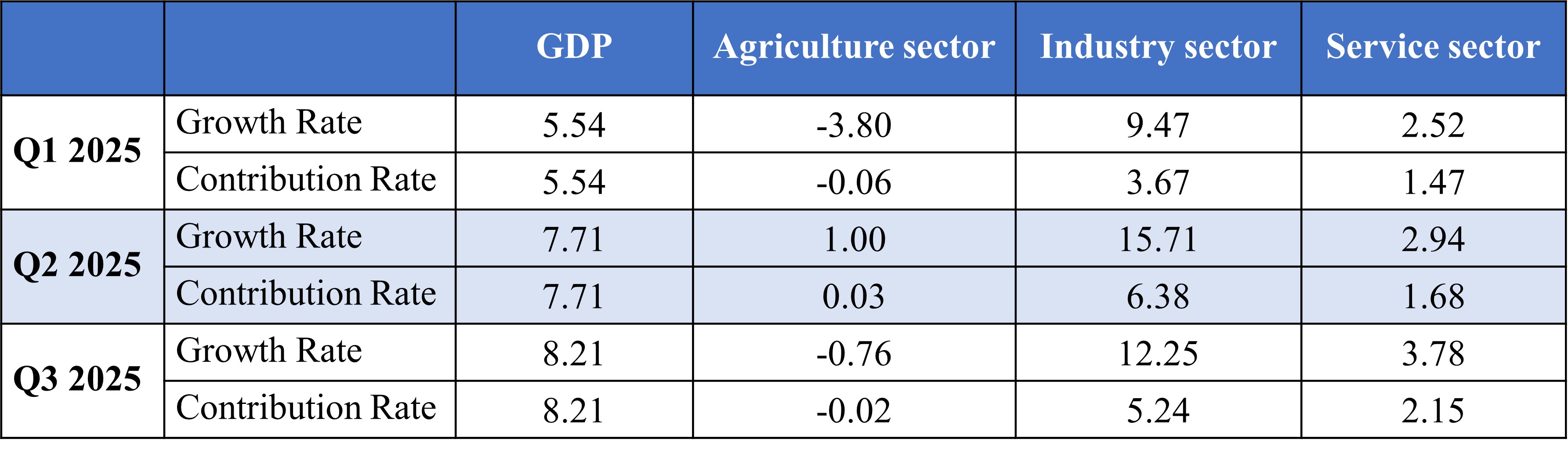

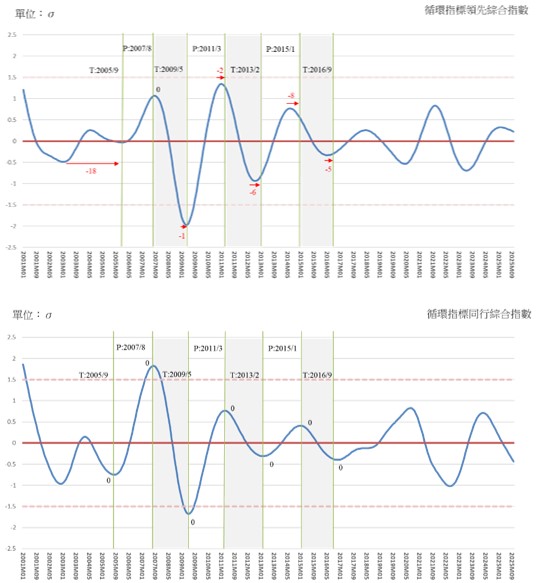

Furthermore, the Leading Cyclical Composite Index for Service Industry (LCCIS), which forecasts the business cycle trend for the Commercial Service Industry, shows a new downward turning point with a peak in February this year, based on the government’s latest Q3 economic growth data analysis. Although the Cyclical Composite Index was still at 0.2272 Standard Deviations in October this year and the decline wasn’t steep, it’s a new warning sign that warrants attention.

The simultaneous decline of both the Leading and Coincident Indicator Cyclical Composite Indices suggests a rising risk of the Commercial Service Industry’s overall economy gradually moving toward recession, which requires close monitoring.

There are some key points and policy implications regarding the current changes in Business Forecast for Taiwan’s Commercial Service Industry as follows:

A. Characteristics of the Business Cycle Trend:

1. The overall economy shows a pattern of “hotter external demand, cooling internal demand,” with the hidden worry of “structural sector decline” becoming evident.

a. Economic growth rates for the first three quarters of this year increased from 5.54% in Q1 to 7.71% in Q2, and further to 8.21% in Q3. During the same period, the contribution of “Net Exports” to economic growth increased from 4.07 percentage points to 5.86 percentage points, and then to 7.57 percentage points in Q3. However, the growth contribution of expenditures representing major domestic demand items, such as Private Consumption and Private Investment, paled in comparison.

b. During the same period, the growth contribution of domestic-demand-oriented Service Sector output was 1.47 percentage points in Q1, 1.68 percentage points in Q2, and 2.15 percentage points in Q3. This is significantly lower compared to the quarterly growth contributions from the Industrial Sector: Q1: 3.67 percentage points, Q2: 6.38 percentage points, and Q3: 5.24 percentage points. The widening gap in economic growth, coupled with the consistently high percentage of Service Sector employment, clearly indicates the stagnation of Service Sector productivity relative to the Industrial Sector (especially high-end electronics, e.g., AI, and semiconductors). This fact, confirmed by the systemic decline of the Commercial Service Industry’s business cycle indicators, further highlights the worry of structural sector decline.

2. The uneven recovery is increasingly divergent, varying between warm and cool, with an increasing number of declining indicators accelerating the risk of the Commercial Service Industry moving toward recession.

a. Among the five Coincident Indicator sub-indicators, four are now declining, with only the Real GDP Index of Wholesale and Retail Industry continuing to rise, achieving a standardized business cycle index of 2.3433. However, the total Cyclical Composite Index for all five sub-indicators is -0.4379. This shows a serious divergence in the uneven recovery across sectors, with a rapidly accelerating spread of declining indicators, posing a high risk of systemic recession.

b. Four out of the seven Leading Indicator sub-indicators are now declining, with only three on an upward trend. This is the first time in the current recovery cycle that the downward Diffusion Index has exceeded the upward one. Although the Cyclical Composite Index remains above the long-term trend value (0), the Leading Cyclical Composite Index has simultaneously reached a downward turning point, moving from rising to falling.

3. Business cycle fluctuations, intertwined with internal structural changes and external shocks, are accelerating.

a. The Commercial Service Industry business cycle trend began to deviate from the Leading Indicator in May last year (2024), shifting from rising to falling. The Leading Indicator then followed suit, peaking and declining in February this year.

Among the Coincident Indicators, the Accommodation and Catering Industry first declined due to labor shortages and rising costs, followed by The Number of Employees in the Service Industry. Subsequently, seven waves of “elective” credit controls implemented by the central bank to curb soaring housing prices and credit risks concentrated in the real estate sector caused changes in homebuyer expectations, leading to a decline in the Real Estate and Residential Service Industry. Now, even the Real Consumption of Residential Services, Utilities, and Other Fuel Industries has begun to decline. Although Wholesale and Retail remains strong, this process reveals a trend toward recession, where supply constraints and policy shocks make it difficult to maintain economic warmth.

Impacts of the pandemic and changes in consumer behavior created low-contact and gig economies. Coupled with the development of digital and mobile technology, this altered employment patterns, resulting in a significant labor market structural shift characterized by structurally induced labor shortages. Concurrently, rising prices weakened general effective demand. The combination of increasing costs and weakening demand severely impacted the domestic market. The central bank’s credit controls, which curbed the real estate boom, are a policy-driven external factor, but they similarly led to an inhibition of overall effective demand. Consequently, the Coincident Indicator Cyclical Composite Index trended downward, thus diverging from the Leading Indicator Cyclical Composite Index.

b. In the Leading Indicator series, the Net Entry Rate of Employees in the Commercial Service Industry, which represents the job market, turned downward in July this year. The Number of the Initial Acceptance of Unemployment Benefits (inverted), although not declining, has nearly stagnated. Important financial market indicators, the Stock Price Index of the Commercial Service Industry and the Real GDP of Finance and Insurance Sector, both peaked and began to decline in September this year. Transportation and Storage Industry peaked and turned downward as early as October the year before (2023). Currently, only Private Real Fixed Capital Formation and Net Trade in Service Revenue and Expenditure remain buoyant.

c. Tariff wars and growth in Net Exports imply a contradiction in sector-specific effects and time lag.

Trump’s initiation of comprehensive yet differentiated tariff wars and trade negotiations against the world had direct and indirect impacts toward Taiwan’s export trade. Furthermore, the ongoing negotiations and changing trade policies in related countries outside the US will create significant, varying, and time-lagged uncertainty risks for Taiwan’s different Industry Sectors. For example, high-tech and electronics (excluding semiconductors) are most directly affected by high tariffs; the semiconductor industry (AI, high-end chips) is temporarily less impacted; and traditional industries (machine tools, apparel, footwear) face the greatest tariff impact. This undoubtedly exacerbates the general economic fluctuation of hot external demand and cold internal demand.

B. Policy Implications of the Current Business Cycle Trend Changes:

1. Facing the uneven recovery and uncertainty risks caused by structural and external shocks, it’s clear that waiting for the overall economic system to self-adjust is insufficient. Traditional simple aggregate fiscal expansion and monetary easing policies are also inadequate responses. The urgent need is to implement sector-appropriate, timely, and localized supply-side reforms based on specific structural characteristics and differences. This necessitates full and rapid cooperation between the government and businesses to address the significant digital economic productivity revolution and the repositioning and deployment of global trade and investment markets.

2. Facing the severe challenge of coexisting opportunities and difficulties, we can indeed feel that both government departments and private enterprises have been unprecedentedly active. However, due to Taiwan’s inherent structural imbalance, coupled with current changes in resource concepts, global supply chain restructuring, and geopolitical shifts in international market relations, the capacity and scope for action by SMEs, which have long been the backbone of Taiwan’s economic resilience, are extremely limited. In principle, a “Smart Cross-Domain Integration and Sharing Platform” model (high-technology, high-knowledge, high-capital intensive) is necessary. Also, imperative is the “Upgraded and Transformed Version” of the traditional industry ecosystem park model, based on friend-shoring and near-shoring concepts, expanding offshore. These two strategies are the essential remedies for SMEs seeking digital transformation to boost productivity and simultaneously overcome challenges such as changing resource value concepts, global supply chain restructuring, and shifting international trade policies, especially given their own limitations and the increasing difficulty of forming clusters.

1. Comprehensive analysis and prediction

The latest statistics from CDRI show that the Coincidental Cyclical Composite Index for Service Industry (CCCIS) reached -0.4379 Standard Deviations in October and is forecasted to continue falling to -0.7782 Standard Deviations by April next year (2026).

The reported CCCIS Cyclical Composite Index of -0.4379 Standard Deviations in October is less severe than the previous forecast of -0.5262 Standard Deviations. Upon closer examination, this isn’t due to an improvement in the overall business cycle trend, but rather the cumulative result of a more divergent, uneven recovery across sectors. Specifically, looking at the Diffusion Index of cyclical movement, among the five sub-indicators, only the Real GDP Index of Wholesale and Retail Industry remains strong and continues to rise, while the rest are declining simultaneously. This suggests that the Commercial Service Industry’s business cycle fluctuation is facing an unprecedented industry structural imbalance-induced recession, which poses a complex and severe challenge to traditional aggregate demand anti-recession policies. This necessitates a “Tailor Policy” based on the differentiated characteristics of sectoral decline. (See Figure 1 and the appendix below)

Figure 1. “Tendencies and Forecasts of the Coincidental Cyclical Composite Index for the Service Industry”

Source: Business Cycle Forecasting Team, CDRI

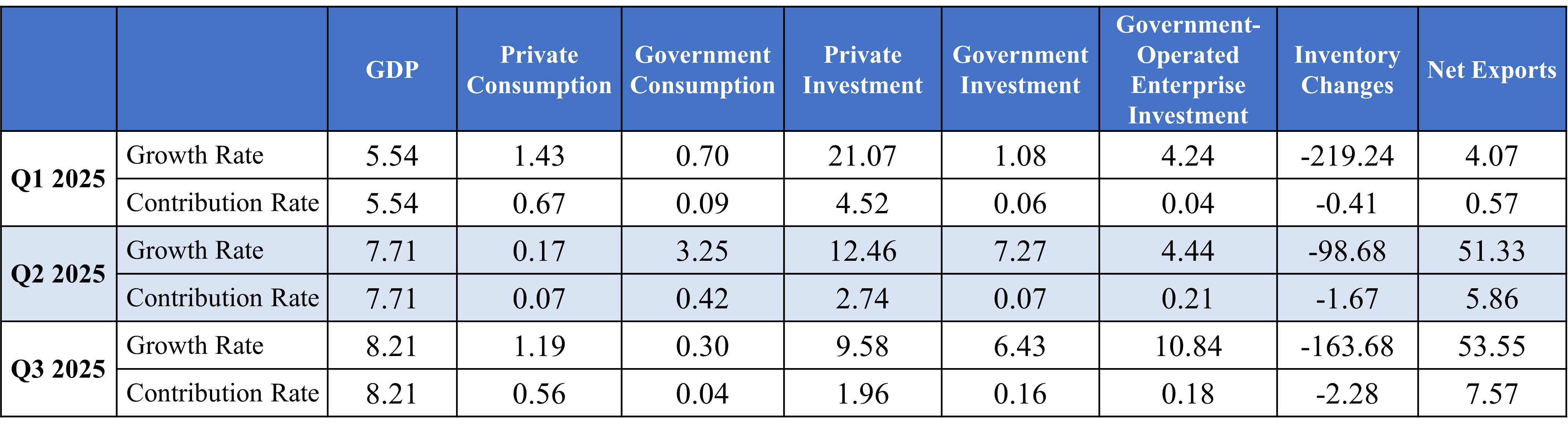

The Directorate-General of Budget, Accounting and Statistics reported that the annual economic growth rates for the first three quarters of 2025 were: Q1 5.54%, Q2 7.71%, and Q3 8.21%.

A review of the quarterly growth rates and contributions by expenditure sector reveals that as the overall economic growth rate increased quarter by quarter, Private Consumption relatively weakened, replaced by Private Investment and, especially, Net Exports.

Their quarterly growth contributions were: Private Consumption: Q1: 0.67 percentage points, Q2: 0.07 percentage points, Q3: 0.56 percentage points; Private Investment: Q1: 4.52 percentage points, Q2: 2.74 percentage points, Q3: 1.96 percentage points. Net Exports, in particular, showed explosive growth, with both the growth rate and contribution continuously rising, especially in Q2 and Q3. Its growth rates in these two quarters reached 51.33% and 53.55%, respectively, with growth contributions as high as 5.86 percentage points and 7.57 percentage points. (See Table 1 below)

Observing by industry sector, the industrial sector maintained a significant relative advantage in growth rates and contributions compared to the Service Sector over the first three quarters of this year, clearly showing the relative decline in Service Sector productivity.

The Industrial Sector’s contribution to economic growth was: Q1: 3.67 percentage points, Q2: 6.38 percentage points, Q3: 5.24 percentage points; while the Service Sector’s was: Q1: 1.47 percentage points, Q2: 1.68 percentage points, Q3: 2.15 percentage points. (See Table 2 below)

The growth rates and contribution comparisons revealed by the government’s Real GDP data confirm the “structural recession” paradox presented by the current business cycle indicator system: the Commercial Service Industry is slowing down and declining against the backdrop of high overall economic growth.

Table 1. Economic Growth Rate and Contribution by Expenditure Sector, Q1-Q3 2025

Unit: %; percentage points

Source: Directorate-General of Budget, Accounting and Statistics, Executive Yuan, and the Business Cycle Forecasting Team of CDRI

Table 2. Economic Growth Rate and Contribution by Industry Sector, Q1-Q3 2025

Unit: %; percentage points

Source: Directorate-General of Budget, Accounting and Statistics, Executive Yuan, and the Business Cycle Forecasting Team of CDRI

2. Service industry business cycle outlook

【Regarding the indicator system】

The business cycle Composite Index system on the Time Series Analysis. We analyze the relevant economic indicators in the time series and select indicators based on their significance to the business cycle and stability of their cyclicality. They are then classified into leading indicators, coincident indicators, and lagged indicators through the use of statistical analysis and verification.

The cyclical trend of the Composite Index of coincident indicators is shown to be highly correlated with the cyclical trend of the GDP, and the forecast value of the Composite Index of the coincident indicators, estimated by the Leading Indicator Composite Index, could be used to forecast the moving trends of the GDP.

The cyclical trend of economic indicators fluctuates around the long-term trend. The long-term trend value is normalized to 100; cyclical trend values greater than 100 indicate a recovery or prosperity stage while values below 100 indicate a recession or depression stage.

The standardized changes of the indicators’ cyclical trend values (in Standard Deviation units) are added up to become a Composite Index, and it fluctuates around the long-term trend value with a Standard Deviation of zero.

The system’s Leading and Coincident Composite Index curves are shown in Figure 2 below:

The latest statistics for the Leading Composite Coincident Index (LCCIS) indicate that, based on the government’s data for the third quarter of this year (2025), a “new downward turning point” was identified, peaking in February this year. This signifies the end of a 20-month continuous upward trend in the leading indicator’s economic cycle. The primary reason is the new “stop-rising-and-turn-down” downward trend observed in the “Net Entry Rate of Commercial Service Employees,” which had previously been continuously rising. Consequently, the balance among the 7 sub-indicators has shifted from the original 4 rising and 3 falling, to a new composition of 4 falling and 3 rising. The composite index has therefore turned from an upward trend to a downward trend.

Among the 7 individual sub-indicators, four showed a downward trend: “Real GDP of Transportation and Storage” (-1.7556 Standard Deviations), “Stock Price Index of the Commercial Service Industry” (-0.7937 Standard Deviations), the newly turning down “Real GDP of Finance and Insurance Sector” (-0.3435 Standard Deviations), and the latest one to reverse downward, “Net Entry Rate of Employees in the Commercial Service Industry” (-0.2293). Those maintaining an upward trend were: “Private Real Fixed Capital Formation” (1.3454 Standard Deviations), “Net Trade in Service Revenue and Expenditure” (3.2528 Standard Deviations), and “Number of the Initial Acceptance of Unemployment Benefits (inverted)” (0.1142 Standard Deviations).

It's noteworthy that the “Net Entry Rate of Employees in the Commercial Service Industry”, which had just rebounded in the previous period, has again reversed to a decrease, indicating inherent volatility. Furthermore, apart from the “Net Trade in Service Revenue and Expenditure” slightly improving, the pace of decline in other downward indicators is accelerating, while the speed of ascent for the upward indicators is slowing. This clearly shows that the overall momentum of the Cyclical Composite Index is weakening significantly, which warrants serious attention.

The latest statistics for the Coincidental Cyclical Composite Index for Service Industry (CCCIS) show it dropped further to -0.4379 Standard Deviations in October. After rebounding post-pandemic, it peaked at 0.7102 Standard Deviations in April of last year (2024), followed by a steady decline, falling to 0.0283 Standard Deviations in March of this year (2025). It then crossed the precise line of the long-term trend value (0) for the business cycle, turning negative, and dropped further to -0.4379 Standard Deviations in October, representing a considerable decrease.

Should this downward trend persist, it is projected to continue falling to -0.7782 Standard Deviations by April next year, indicating an increasing risk of recession.

Comparing the individual sub-indicators, recovery is uneven and divergence is widening, yet the overall trend is downward, with only the “Real GDP Index of Wholesale and Retail Industry” sub-indicator standing out. The other four sub-indicators are collectively declining. This suggests that the risk of recession is increasing in the Commercial Service Industry amidst a diverging recovery. (See Figure 1 above and the appended table below.)

Among the individual sub-indicators for the Coincident Indicator, those continuing a downward trend include three: “Accommodation and Catering Industry,” “Real Estate and Residential Service Industry,” and “The Number of Employees in the Service Industry.” Their business cycle variations are, respectively: -1.6922, -2.1708, and -1.1100 Standard Deviations. “Real Consumption of Residential Services, Utilities, and Other Fuel Industries” has also stopped rising and reversed to a decline. The only one still moving upward is the “Wholesale and Retail Industry” sub-indicator, with its standardized business cycle trend value at 2.3433 Standard Deviations.

Figure 2. Leading and Coincidental Cyclical Composite Index for the Service Industry

Source: Business Cycle Forecasting Team, CDRI

A. Leading indicator series (seven sub-indicators)

a. The business cycle trend for the Real GDP of Transportation and Storage Industry has been on a continuous decline for 24 consecutive months as of October this year (2025), with no sign of slowing down. The standardized business cycle trend value has dropped to -1.7556 Standard Deviations. The actual year-on-year growth rate has also continued to moderate, averaging only 1.26% over the last five quarters. This contrasts sharply with the preceding five quarters, from Q2 2023 to Q2 2024, during which the rate gradually decreased from 44.3% to 6.7%. The business cycle change is showing severe sluggishness and inertia, urgently requiring the formulation of anti-recessionary measures.

The business cycle trend value for this indicator reversed downward in October of the year before last (2023), ending a 24-month period of ascent. It has now been declining for 24 consecutive months as of October this year (2025), with the trend value falling to 94.60. This level has remained below the long-term trend value (100) for 10 months, and the decline shows no sign of abating.

Furthermore, the year-on-year growth rate (yoy) calculated based on the actual GDP value reached a high of 44.3% in Q2 2023, then continuously decelerated, dropping to just 2.0% by Q3 2025. This clearly shows a persistent downward trend in the business cycle, necessitating prompt action to devise anti-recessionary countermeasures.

Figure 3. The annual growth rate of Transportation and Storage GDP and business cycle trend, 2020Q1~2025Q3

Source: Business Cycle Forecasting Team, CDRI and Directorate General of Budget, Accounting and Statistics, Executive Yuan

b. The business cycle trend for Private Real Fixed Capital Formation has been rising since January of last year (2024), reaching 22 months as of October this year (2025). Although the pace of ascent has slowed considerably since H2 this year compared to H2 last year, its economic condition remains robust. The actual year-on-year growth rate also turned positive from negative in Q2 2024 and accelerated quarter-by-quarter, with the growth rate in Q1 2025 even reaching 21.1%. Growth remained strong at 12.5% and 9.6% in Q2 and Q3, respectively. This holds significant positive value and meaning given the severe uncertainty arising from the current Trump-initiated tariff war. However, in the new global economic landscape of digital transformation, coupled with the long-standing structural growth imbalance in our nation, the uneven trend and resource allocation of Private Investment will generate both positive and negative feedback effects, warranting further investigation.

The cyclical trend value for this indicator bottomed out in December of the year before last (2023) at 94.65. It has since continued to rise for 22 months, reaching 104.57 in October this year (2025). The standardized business cycle variation index has risen to 1.3454 Standard Deviations, indicating that a new wave of investment fervor is ongoing.

Furthermore, the year-on-year growth rate (yoy) calculated based on its actual value turned positive from negative in Q2 2024, ending a streak of five consecutive quarters of negative growth. The average growth rate over the six quarters up to Q3 2025 reached an even higher 12.8%. This clearly shows that the domestic investment boom is beginning to usher in a new wave of hope, which carries an extremely positive and powerful significance amidst the current uncertainty of the Trump-initiated tariff war.

Figure 4. Annual growth rate and cyclical trend of Private Real Fixed Capital formation, 2020Q1~2025Q3

Source: Business Cycle Forecasting Team, CDRI and Directorate General of Budget, Accounting and Statistics, Executive Yuan

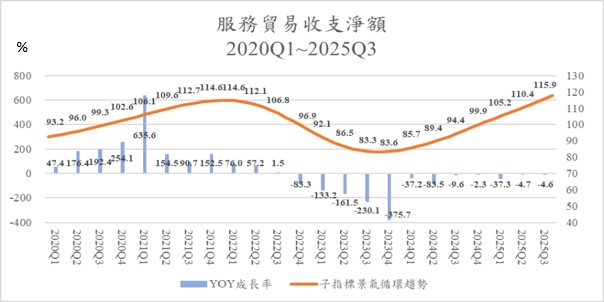

c. The Net Trade in Service Revenue and Expenditure saw a historically rare surplus during the pandemic but has now reverted to the old normal of a deficit. The deficit reappeared in Q1 2023, and its expansion continued to intensify, with the year-on-year decrease in net revenue and expenditure reaching as high as -375.7% in Q4 2023. However, it decreased to -37.2% and -83.5% in Q1 2024 and Q2 2024, respectively, and averaged -11.7% over the five quarters up to Q3 2025. The shrinking growth in the net deficit indicates that the business cycle trend value stopped falling and rebounded in October 2023, climbing from its trough of 83.28 in September to 119.66 in October this year. Due to the steep decline, the standardized business cycle variation index soared to 3.2528 Standard Deviations in October this year. Concurrently, the ratio of the services trade deficit to the goods trade surplus has significantly improved, dropping from 14.1% in the first three quarters of last year to 10.2% in the first three quarters of this year. This marked improvement in Taiwan’s overall international balance and structure contributed to a further expansion of the aggregate trade surplus, which grew by 42.4% compared to the same period.

In terms of actual values, Taiwan’s Service Sector, which saw a rare trade surplus starting in Q2 2020, returned to a deficit in Q1 2023 after 11 quarters. The total services trade deficit for the full year of 2023 reached $10.09 billion USD, equivalent to 10.55% of the $95.617 billion USD goods surplus in the same period. In 2024, the services deficit was $12.173 billion USD, or 12.24% of the $99.416 billion USD goods surplus. The services trade deficit for the first three quarters of 2025 was $11.56 billion USD, which is 10.2% of the $113.698 billion USD goods trade surplus. This is lower than the 14.1% ratio seen in the first three quarters of last year, when the services trade deficit was $10.349 billion USD against a goods trade surplus of $73.616 billion USD. This demonstrates a clear improvement in the ratio of the services trade deficit to the goods trade surplus.

Figure 5. Annual growth rate and cyclical trend of net trade in Services Revenue and Expenditure, 2020Q1~2025Q3

Source: Business Cycle Forecasting Team, CDRI and Directorate General of Budget, Accounting and Statistics, Executive Yuan

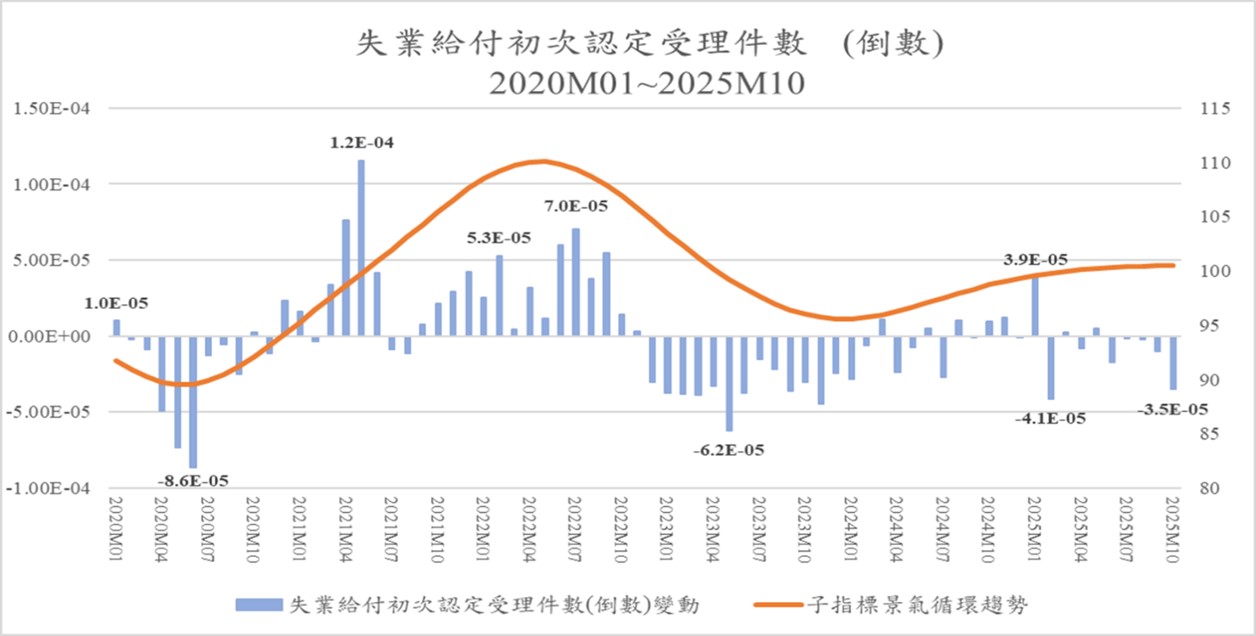

d. The trend for the Number of the Initial Acceptance of Unemployment Benefits (inverted) continues to move upward, signaling a sustained increase in overall labor demand pressure, but the magnitude of change is gradually narrowing, showing signs of deceleration.

The unemployment rate is a lagging indicator of the business cycle. The Number of the Initial Acceptance of Unemployment Benefits can lead the unemployment rate, and a lagging indicator, when inverted, can in turn lead a Leading Indicator. Therefore, the Inverted Number of the Initial Acceptance of Unemployment Benefits can be treated as a Leading Cyclical Composite Index indicator. Employment is a Coincident Indicator of the business cycle, meaning the inverted number of initial accepted claims for unemployment benefits can lead employment.

The business cycle trend for this indicator peaked in May 2022, reaching an index value of 110.06, which indicated a rapid recovery in labor demand. However, it subsequently stopped rising and reversed to a decline. By May 2023, the business cycle trend value for this inverted indicator began to fall below the long-term trend value of 100. It bottomed out in January last year (2024), with the trend value dropping to 95.59. It then reversed and started ascending, signaling the end of the downward trend in labor demand. As of October this year (2025), it has risen to 100.48, indicating that the labor demand trend continues to increase, but the rate of increase has clearly diminished, showing signs of deceleration. The standardized business cycle variation index is only 0.1142 Standard Deviations.

Figure 6. Number of the initial acceptance of unemployment benefits (inverted) and the annual growth rate and cyclical trend January 2020 to October 2025

Source: Business Cycle Forecasting Team, CDRI and Directorate General of Budget, Accounting and Statistics, Executive Yuan

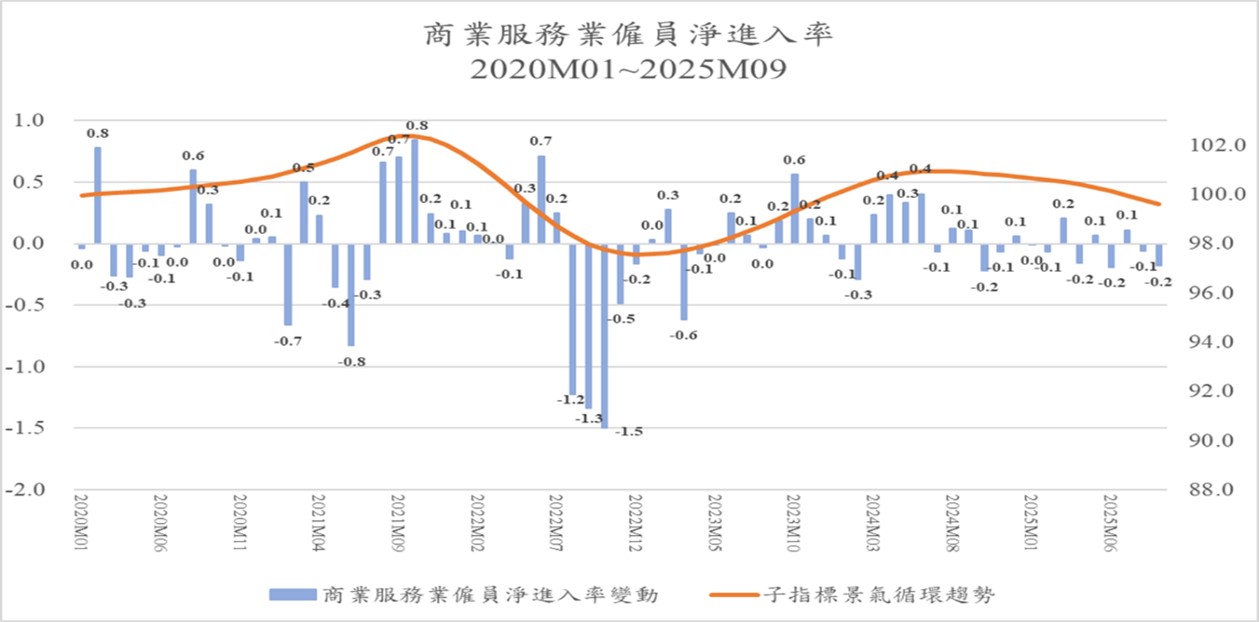

e. The reversal of the business cycle trend for the Net Entry Rate of Employees in the Commercial Service Industry from rising to falling marks a major turning point in the service sector employment market. The standardized business cycle variation index reached -0.2293 Standard Deviations in October this year (2025), indicating a new trend where the quantity of Commercial Service Industry employment is beginning to decrease after having increased.

The cyclical trend for this indicator bottomed out in December 2022, with a business cycle trend value of 97.56. It ascended continuously, peaking in July last year (2024) with a business cycle trend value of 100.94. Subsequently, it reversed and began to decline, with the magnitude of the decrease gradually increasing. By October this year, the business cycle trend value was 99.42, falling below the long-term trend value (100). The standardized business cycle variation index has decreased to -0.2293 Standard Deviations.

Figure 7. Annual changes and cyclical trends in the net entry rate of Employees in the Commercial Service Industry, January 2020 to September 2025

Source: Business Cycle Forecasting Team, CDRI and Directorate General of Budget, Accounting and Statistics, Executive Yuan

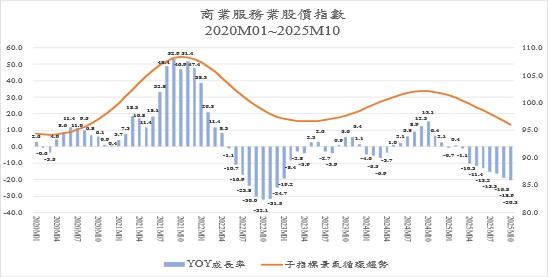

f. The downward trend in the business cycle for the Stock Price Index of the Commercial Service Industry bottomed out in April of the year before last (2023) and rebounded all the way until it peaked in September last year (2024). Since then, it has been declining for 13 consecutive months through October this year (2025), with the pace of decline slightly accelerating. The business cycle trend value has fallen to 95.94, which is below the long-term trend value (100), and the standardized business cycle variation index is now -0.7937 Standard Deviations. This indicator clearly signals the Commercial Service Industry heading towards recession and warrants close attention.

The business cycle trend for this indicator ended an 18-month decline in April 2023 and subsequently rose for 17 months, peaking in September last year (2024) with a cyclical trend value of 102.09. It has since been declining, and as of October this year (2025), the business cycle variation has continued to fall for 13 months, with the trend value at 95.94 and the speed of decline accelerating. The standardized business cycle variation index has also dropped to -0.7937 Standard Deviations, serving as a warning sign guiding the Commercial Service Industry toward recession, which should be closely noted.

Furthermore, the year-on-year growth rate (yoy) of the actual stock price index showed growth from May to December last year (2024). However, the increase peaked at 15.1% in October, after which the rate of increase was moderated. Since the beginning of this year, it has shown negative growth, deteriorating steadily, with the year-on-year growth rate in October this year even falling to -20.3%. This clearly demonstrates the downward movement of the business cycle.

Figure 8. The annual growth rate and circular trend of the Stock Price Index of the commercial service industry, January 2020 to October 2025

Source: Business Cycle Forecasting Team, CDRI and Directorate General of Budget, Accounting and Statistics, Executive Yuan

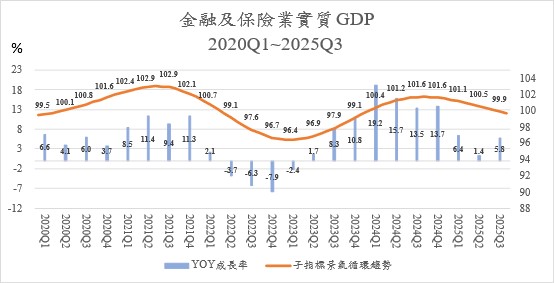

g. The year-on-year growth rate for the Real GDP of Finance and Insurance Sector started to recover growth in Q2 2023, ending four consecutive quarters of negative growth. It quickly reached a growth peak of 19.2 in Q1 last year (2024), followed by a sequential slowdown, entering single-digit growth this year (2025). Concurrently, the business cycle trend bottomed out in February 2023 and continued to rise, peaking in September last year (2024). As of October this year (2025), the cyclical index has dropped to 99.47, which is below the long-term trend value (100). The standardized business cycle variation index has also decreased to -0.3435 Standard Deviations, signaling an initial indication of a downward pull on the Commercial Service Industry, which should be closely noted.

The cyclical trend for this indicator bottomed out in February of the year before last (2023), with a cyclical trend value of 96.42. After rebounding for 19 months, it peaked in September last year (2024). As of October this year (2025), it has decreased to 99.47, and the standardized business cycle variation index is -0.3435 Standard Deviations.

Furthermore, the year-on-year growth rate of the actual value of this indicator began to decline and turned negative in Q2 2022. It did not return to positive growth until Q2 2023. Its growth magnitude reached a high of 19.2 in Q1 last year (2024), then gradually moderated, becoming 1.4 and 5.8 in Q1 and Q2 this year (2025), respectively. This confirms that the business cycle trend is clearly moving downward after growth stagnation, suggesting an initial sign that may lead the Commercial Service Industry into a recessionary trend, which warrants close attention.

Figure 9. Annual growth rate and cyclical trend of real GDP of Finance and Insurance Sector, 2020Q1~2025Q3

Source: Business Cycle Forecasting Team, CDRI and Directorate General of Budget, Accounting and Statistics, Executive Yuan

B. Coincident indicator series (five sub-indicators)

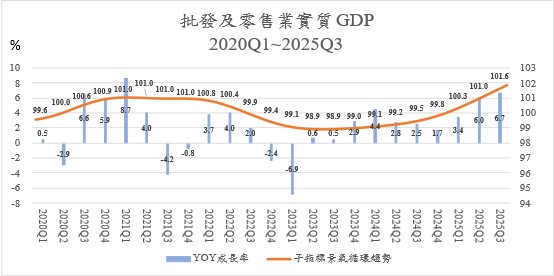

a. The business cycle trend and actual value of the Real GDP Index of Wholesale and Retail Industry are both continuously rising, with no reduction in the rate of ascent, indicating that the economic climate of this industry remains in a stable recovery.

The cyclical trend value for this indicator reached its trough in June of the year before last (2023), with a trend value of 98.91. After 28 consecutive months of ascent, it reached 102.08 in October this year (2025), showing that the economy is continuing its stable recovery.

Furthermore, the year-on-year growth rate of the actual value turned positive from negative in Q2 of the year before last (2023), with a year-on-year growth rate of 0.6. It has since maintained growth, with the growth rate fluctuating upward, spiking to 6.0 and 6.7 in Q2 and Q3 this year (2025), respectively. This demonstrates that the economic climate of this industry continues to be in a stable recovery.

Figure 10. Annual growth rate and cyclical trend of real GDP Index of Wholesale and Retail, 2020Q1~2025Q3

Source: Business Cycle Forecasting Team, CDRI and Directorate General of Budget, Accounting and Statistics, Executive Yuan

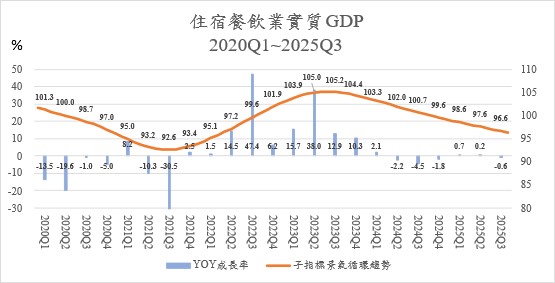

b. The Real GDP of the Accommodation and Catering Industry peaked in July of the year before last (2023), and the cyclical trend has been declining for 27 consecutive months through October this year (2025), indicating a sustained economic downturn. Its actual value showed negative growth in Q2, Q3, and Q4 last year (2024). Although it slightly increased in Q1 and Q2 this year (2025), it declined again by 0.6 in Q3, confirming a persistent downward movement in the business cycle. The standardized business cycle trend value has dropped to -1.6922 Standard Deviations, showing that this industry has entered a state of recession.

The cyclical index for this indicator reached its peak of 105.22 in July of the year before last (2023), then reversed and began to decline, with the business cycle trend value reaching 95.97 in October this year (2025). Notably, the pace of its decline accelerated again in Q3 this year.

Furthermore, the year-on-year growth rate of the actual value, severely impacted by the pandemic, saw its worst decline of -30.5 in Q3 2021. It then stopped falling and rebounded, but the quarterly growth rates have fluctuated significantly. It recorded two instances of exceptionally high growth in Q3 2022 and Q2 of the year before last (2023), reaching 47.4 and 38, respectively. Following this, it declined steadily, even showing decreases of -2.2, -4.5, and -1.8 in Q2, Q3, and Q4 last year (2024), respectively, entering a technical recession. Although it slightly increased by 0.7 and 0.2 in Q1 and Q2 this year (2025), it recorded negative growth of -0.6 again in Q3, demonstrating that the business cycle has entered a state of recession amidst fluctuation.

Figure 11. The annual growth rate and circular trend of real GDP in the Accommodation and Catering Industry, 2020Q1~2025Q3

Source: Business Cycle Forecasting Team, CDRI and Directorate General of Budget, Accounting and Statistics, Executive Yuan

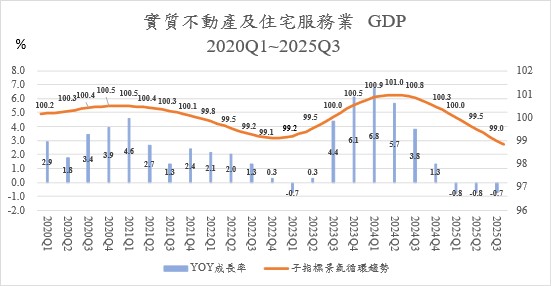

c. The latest business cycle variation for the Real Estate and Residential Service Industry GDP peaked in May last year (2024) and has been declining for 17 consecutive months through October this year (2025). Concurrently, the actual year-on-year growth rate has also declined quarter-by-quarter from its peak of 6.8 in Q1 last year (2024), with the pace of decline continuously accelerating. It has shown two consecutive quarters of negative growth at -0.8 in the first half of this year, with Q3 seeing another -0.7. The standardized business cycle variation has dropped to -2.1708 Standard Deviations, a severity higher than the -1.6922 Standard Deviations observed in the Accommodation and Catering Industry, indicating that this sector is rapidly plunging into a decline.

The cyclical trend for this indicator has shown slight long-term fluctuations. The index peaked in January 2021 and reached a trough in November 2022. It then accelerated its recovery, with the cyclical trend value reaching a peak of 100.96 in May last year (2024). Subsequently, it reversed and turned downward, with the cyclical trend value decreasing to 98.66 by October this year (2025), simultaneously showing a tendency for the pace of decline to continually accelerate. The standardized business cycle variation is -2.1708 Standard Deviations. The situation is progressively becoming severe, as it is rapidly plummeting and has entered a state of recession.

For the changes in the actual year-on-year growth rate, refer to the numbers shown in the bar chart for each quarter below. Q1 2023 saw negative growth of -0.7, followed by a quarterly ascent to the highest point of 6.8 in Q1 last year (2024). It then slowed down, declining quarter by quarter to two consecutive quarters of negative growth at -0.8 this year (2025), with Q3 seeing another -0.7. This shows that this industry has entered a state of recession.

Figure 12. Annual GDP growth rate and cyclical tendency of Real Estate and Residential Service Industry, 2020Q1~2025Q3

Source: Business Cycle Forecasting Team, CDRI and Directorate General of Budget, Accounting and Statistics, Executive Yuan

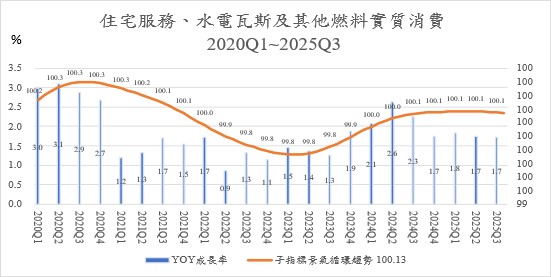

d. The business cycle of Real Consumption of Residential Services, Utilities, and Other Fuel Industries has exhibited minor long-term fluctuations. Notably, the business cycle trend slightly declined for 30 months starting in October 2020, bottoming out in March of the year before last (2023). It then recovered for 24 months from April 2023 until March this year (2025). However, it reversed to a decline in April this year (2025). Although the magnitude of the drop in the business cycle trend value is slight, it suggests a potential downward risk in economic activity.

The cyclical trend for this indicator experiences minor long-term fluctuations, and its actual value has never shown negative growth, although fluctuations in the growth rate still demonstrate a “growth cycle.” The business cycle trend value reached its peak in September 2020 and bottomed out in March of the year before last (2023). It then reversed and rose for 24 months, reaching a peak of 100.08 in March this year (2025), after which it subtly turned downward.

Furthermore, the year-on-year growth rate of the actual value has shown growth every quarter since 2020, but the magnitude is small, fluctuating between a maximum of 3.1 (Q2 2020) and a minimum of 0.9 (Q2 2022). The recent high point was 2.6 (Q2 last year), 1.7 in Q4 last year, 1.8 in Q1 this year (2025), and 1.7 in both Q2 and Q3. The quarterly changes are illustrated in the figure below.

Figure 13. Real Consumption of Residential Services, Utilities, and Other Fuel Industries, 2020Q1~2025Q3

Source: Business Cycle Forecasting Team, CDRI and Directorate General of Budget, Accounting and Statistics, Executive Yuan

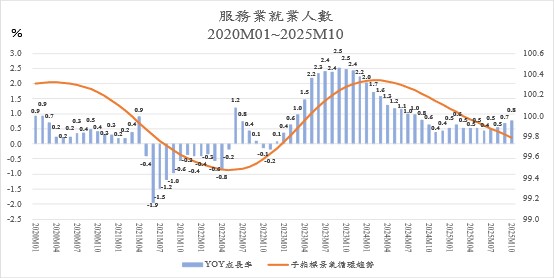

e. The business cycle trend for The Number of Employees in the Service Industry continuously rose starting from June 2022, reaching its peak in February last year (2024). It then reversed and turned downward, with the business cycle trend value dropping to 99.79 by October this year (2025), which is below the long-term trend value (100). This indicates a decline that has lasted for 20 consecutive months. Although the downward trend is slight, no signs of improvement have been observed, and the standardized business cycle trend value has decreased to -1.1100 Standard Deviations, warranting special attention.

The business cycle trend for this indicator reached a trough in May 2022. The subsequent upward trend gradually strengthened, peaking in February last year (2024). It then reversed and moved downward, with the business cycle trend value decreasing to 99.79 by October this year (2025). (The standardized business cycle variation value is -1.1100 Standard Deviations, with a severity close to the -1.6922 Standard Deviations seen in the Accommodation and Catering Industry.)

Furthermore, the year-on-year growth rate of the actual value has shown consecutive growth since December 2022, with the magnitude of growth progressively increasing, rising from 0.1 in December 2022 all the way to 2.5 in September and October of the year before last (2023). It then slowed down, declining to 0.4 in November and December last year (2024). Starting from a high of 0.6 in February this year, it slightly moderated to 0.5 in July and August, then slightly rose to 0.7 and 0.8 in September and October. This reflects concerns over the sluggish growth of employment due to increased labor shortage pressure during the economic recovery.

Figure 14. The growth rate and cyclical tendency of The Number of Employees in the Service Industry, January 2020 to October 2025

Source: Business Cycle Forecasting Team, CDRI and Directorate General of Budget, Accounting and Statistics, Executive Yuan

C. Lagged indicator series

The lagged indicator includes Real Consumption of Tobacco and Alcohol, Real Consumption of Clothing, Footwear, and Apparel, Real Consumption of Furniture, Equipment, and Housekeeping, and the Number of Initial Recognition and Acceptance of Unemployment Benefits. The Lagged Index can be used as a reference for observing whether a business cycle is over. This article omits relevant analysis.

Appendix

Business Cycle Coincident Composite Index for Taiwan Service Sector

|

Year/Month

|

Deviation of Standardized Cyclical Coincident Composite Index

(Unit: σ, Benchmark: 0)

|

Remark

|

|

2026-04

|

-0.7782

|

(P)

|

Use ARMA Model: (4,0)(0,0) to make predictions based on the leading effect set for half year

|

|

2026-03

|

-0.7355

|

(P)

|

|

2026-02

|

-0.6847

|

(P)

|

|

2026-01

|

-0.6279

|

(P)

|

|

2025-12

|

-0.5668

|

(P)

|

|

2025-11

|

-0.5031

|

(P)

|

|

2025-10

|

-0.4379

|

(f)

|

The estimated value of the Coincident Composite Index

|

|

2025-09

|

-0.3722

|

(a)

|

The actual value of the Coincident Composite Index

|

|

2025-08

|

-0.3063

|

(a)

|

|

2025-07

|

-0.2402

|

(a)

|

|

Source: Business Cycle Forecasting Team, CDRI

Note:

1. (a): actual; (f): estimated; (p): predicted.

2. The most recent reference cycle turning point: September 2016 (trough).

3. Leading indicator sub-indicators: (1) Real GDP of the Transportation and Storage Industry*, (2) Private Real Fixed Capital Formation*, (3) Net Balance of Trade in Services Revenue and Expenditure*, (4) Initial Acceptance of Unemployment Benefits (inverted), (5) Net Entry Rate of Employees in the Commercial Services Industry, (6) Stock Price Index of the Commercial Service Industry, (7) Real GDP of Finance and Insurance*.

4. Coincident indicator sub-indicators: (1) Real GDP of Wholesale and Retail Industry*, (2) Real GDP of Accommodation and Catering Industry*, (3) Real GDP of Real Estate and Residential Industry*, (4) Real Consumption of Residential Services, Utilities, and Other Fuel Industries*, (5) Number of Employees in the Service Industry.

5. Lagging indicator sub-indicators: (1) Real Consumption of Tobacco and Alcohol*, (2) Real Consumption of Clothing, Footwear, and Accessories*, (3) Real Consumption of Furniture, Equipment, and Household Maintenance*, (4) Initial Acceptance of Unemployment Benefits.

* Indicates that these indicators are calculated based on quarterly data and may require extrapolation due to data limitations.

|